What Happens If I Die Without A Will In Ontario?

Will-writing can sometimes feel like a taboo subject. After all, talking about what happens when you die is a pretty uncomfortable thing to do!

But that fear often keeps people from doing something everyone needs to do. Truth is, making a Will isn’t the scary part—it’s much more frightening to consider what happens if you don’t have a Will.

What happens if you don’t have a Will in Ontario

If you don’t have a Will when you die, you die intestate.

Dying intestate means you won’t get a say in important decisions like how your assets get distributed or who will look after your children (if your spouse passed away as well.) For the ones you leave behind, it also means lots of time, effort, and money spent wrapping up your affairs.

You don’t get to decide how to distribute your assets

Wills are important because they let you choose who gets your assets when you die.

If you don’t have a Will when you die, the courts distribute everything you own according to the laws of your province (or territory.) By not having a Will, you give up all control when it comes to where your assets end up.

Since the courts don’t know the particulars of your situation the way that you do, they apply the same laws to everyone. These laws allow very little flexibility and rarely consider the unique circumstances of each family.

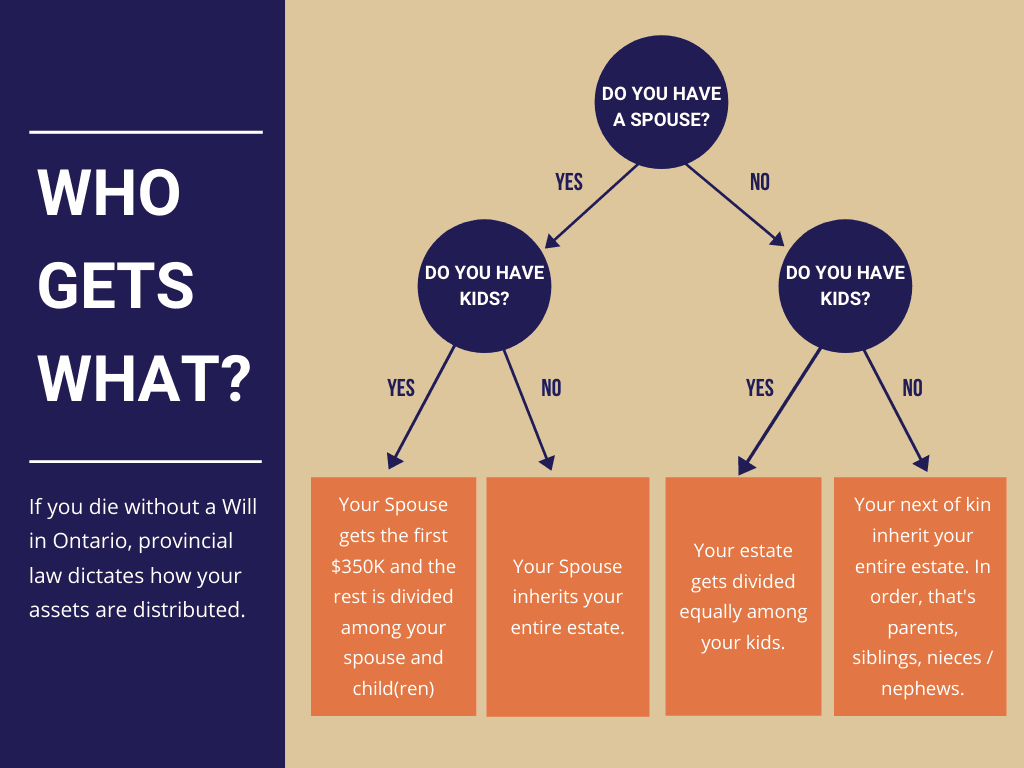

Every province’s laws differ a little, but most share the same basic characteristics:

If you have a spouse but no child(ren):

your spouse inherits your entire estate.

If you have no spouse or kids:

your parents inherit your entire estate.

If you have a spouse and child(ren):

your spouse gets a specific portion of your estate, and your child(ren) shares the remainder. This rule varies, and the proportions each person gets often depends on the size of your estate.

If you have any kids but no spouse:

they share your estate equally.

If you don’t have a spouse, children, or parents:

your brothers and sisters share your estate equally. If you have no siblings, your nieces and nephews split your estate.

Update: As of March 1, 2021, if a couple has children together, a surviving spouse inherits $350,000 (up from $200,000) of their partner's estate before the rest gets divided among the spouse and children.

Keep in mind that provincial laws may not always match up with what you would have wanted when it comes to the division of your assets.

For example, if you have a surviving spouse but no children, you may not want your spouse to get your entire estate. Maybe you want them to share your assets with your parents, siblings, or other family and friends. Without a Will, you don’t have that option.

Or, if you’re in the middle of a separation but not yet divorced, the courts still see your partner as your lawful spouse. Even if you wanted to leave your estate to other family members and friends, your estranged spouse could end up getting everything.

Letting the courts decide how to distribute your assets often leads to family tension. Disagreements around who gets what can lead to arguments and even litigation.

You don’t get to choose who will care for your children

Another good reason to have a Will is that it enables you to appoint a guardian. A guardian is someone who looks after your children if you die before they become adults (and your partner is also no longer alive.)

If you have a surviving spouse, in most cases they will care for your children. But if both you and your spouse pass away and you don’t have a Will that names a guardian, the courts make the call for you.

The court chooses the person they think will be best suited to act as your children’s caretaker. But it's an issue if you disagree with who they choose—and if you're no longer alive, you won’t get a say.

In Ontario, your guardian assumes their role for 90 days, and then the court appoints a permanent legal guardian. If you name a guardian in your Will, it’s extremely likely the court appoints that person.

Of course, it’s possible someone may contest your decision in court. For example, you might appoint your parents as guardians, but your spouse’s parents might also really want to care for your children.

If you and your spouse aren’t alive and someone contests your decision, the information in your Will carries a lot of weight. After all, you’re the best person to decide who should take care of your kids.

Your loved ones could spend a long time sorting out your matters

When you die, your financial obligations don’t automatically disappear.

Dying without a Will can leave your loved ones in an administrative nightmare. Who will pay your loan payments? Who will close your credit card accounts? Who will pay your taxes? (Yes, you're even taxed in death!)

Spoiler alert: it’s your family.

The first thing your next of kin needs to do is apply to act as your executor (since you don’t have a Will appointing one.) This person is sometimes called an estate trustee.

An executor/estate trustee has the power and responsibility to carry out your personal wishes. Their duties also include paying your taxes and debts (out of your estate), closing your bank accounts, and tying up any other business you left unfinished—including selling real estate property to pay your debts, if necessary.

Your executor should be a person you trust, not only with your personal wishes but also with the financial side of things. If you die intestate, you won’t have the opportunity to choose who that person is.

Closing thoughts

Considering the major drawbacks of dying intestate, you’d think most Canadians would have a Will in place. But you’d be wrong. Studies show over two-thirds of Canadians don’t have an up-to-date Will—with many citing cost and lack of time as reasons why.

But estate planning is evolving fast and Canadians no longer need to shell out thousands of dollars at an estate planning lawyer’s office to get a simple Will done. There are online options, like Epilogue, to help you make a basic Will for a fraction of the time and cost of using a lawyer. And not having a Will means losing control over what are arguably the most important decisions you’ll ever have to make.

You work hard to take care of your family your whole life. Carving out the time to think about and write your Will is the best way to make sure your loved ones are cared for after you’re gone as well.